[ad_1]

The housing marketplace may well be slowing down, but possessing a household is nevertheless a pricey proposition. Two charts reveal specifically how highly-priced it is.

Just around a calendar year back, the monthly value of owning and leasing were virtually identical, in accordance to a blog site post from John Burns Actual Estate Consulting. “Now, proudly owning a dwelling charges $839 more per month than renting. This differential is almost $200 bigger than at any time since the change of the century,” Danielle Nguyen, senior study supervisor at John Burns wrote.

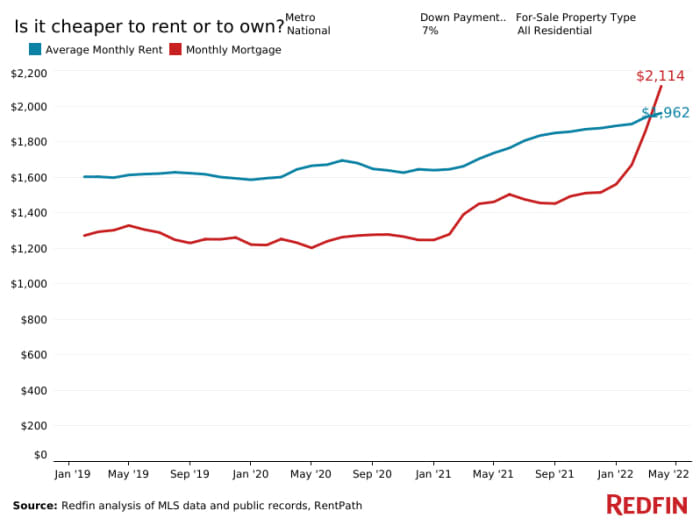

Throughout household qualities, renting a residence would set just one again roughly $1,962 a month, in accordance to details from Redfin, as of April 2022. But if a house owner experienced set down a 7% down payment for a dwelling, they’d be caught with a mortgage loan that would set them again $2,114 a month — $152 more.

“With demand from customers now shifting towards renting, dwelling builders who have been as soon as unwilling to offer to rental home traders are now soliciting gives from investors,” Nguyen extra. “Strong need from buyers will deliver added guidance to today’s home rates.”

The historical hole involving possessing and renting can be seen in the chart down below:

On the lookout forward, on the other hand, Nguyen told MarketWatch, “High household rates and mounting desire fees may well impression property potential buyers.” Fewer persons can now qualify for homes, she stated. In fact, to start with-time customers are more and more priced out of the country’s best actual-estate marketplaces.

This homebuyer penalty hits harder in some spots in the nation, in accordance to John Burns. In places wherever house costs accelerated the most, like Raleigh-Durham, Nashville, Denver, Tampa, and Phoenix, owning a dwelling was significantly a lot more costly than leasing.

John Burns Consulting assumed the buy of a residence at 80% of the recent median value. They also believe that the buyer put down a 5% down payment with a 30-12 months set-amount home loan.

To put that in context: A year in the past, leasing would have set you again $1,705 a month, as in comparison to a monthly home loan payment of $1,451, the National Affiliation of Realtors said in a weblog publish in January.

The price tag to individual a residence went up since house selling prices have been soaring considering that the start out of the COVID-19 pandemic, as individuals moved out of crowded towns aided by their potential to operate remotely. Growing building fees and the shortage of stock also assisted to drive up selling prices.

The regular worth of a house as of Could 31 was almost $350,000, in accordance to Zillow

Z,

In January 2020, correct prior to the pandemic commenced to spread across the state, the regular household was valued at $251,000.

In March 2022, the median house constitutes about 38.6% of a person who is earning the median cash flow of $68,000 a calendar year, up from 30.2% in March 2021, according to the Atlanta Federal Reserve.

The Dow Jones Industrial Average

DJIA,

tech-major Nasdaq Composite

COMP,

and S&P 500

SPX,

shut decrease on Thursday following growing on Wednesday on the again of the U.S. Federal Reserve’s 75-basis-issue amount hike.

Obtained thoughts on the housing market place? Generate to MarketWatch reporter Aarthi Swaminathan at [email protected].

[ad_2]

Supply backlink

More Stories

Great Kids Books Parents Won’t Mind Reading Again… and Again

How to Upgrade an Old Property

Top Tips When Sound Proofing Metal Structures